TORONTO, April 10, 2025 (GLOBE NEWSWIRE) — NexGold Mining Corp. (TSXV: NEXG; OTCQX: NXGCF) (“NexGold” or the “Company”) is pleased to provide drill results from the ongoing 25,000-metre diamond drill program at the Goliath Gold Complex. Results have been received for recent drilling at both the western end of the Goliath Deposit (“Goliath West”) and the Far East Prospect (“Far East”), located eight kilometres east of the Goliath Deposit.

Selected drill intercepts from Goliath West are provided in Table 1 and include:

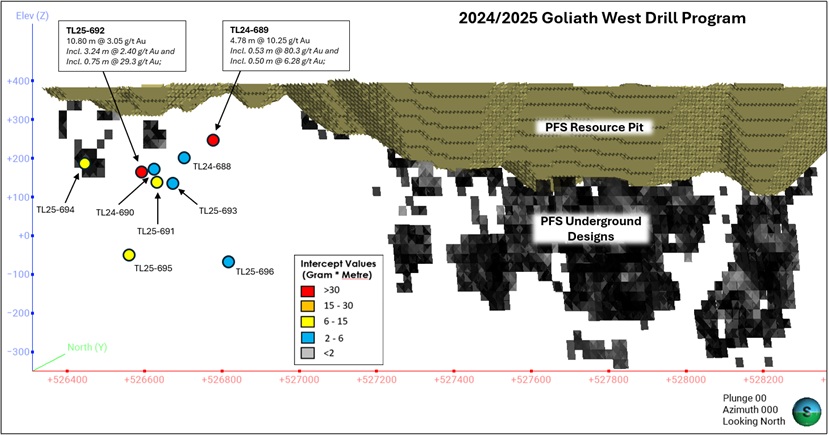

- 10.25 g/t gold and 2.81 g/t silver over 4.78 metres, including 80.30 g/t gold and 13.60 g/t silver over 0.53 metre and including 6.28 g/t gold and 3.10 g/t silver over 0.50 metre in drill hole TL24-689;

- 3.05 g/t gold and 2.06 g/t silver over 10.80 metres, including 2.40 g/t gold and 3.49 g/t silver over 3.24 metres and including 29.30 g/t gold and 5.70 g/t silver over 0.75 metre in drill hole TL25-692;

- 0.69 g/t gold and 0.98 g/t silver over 19.84 metres, including 12.20 g/t gold and 7.10 g/t silver over 0.50 metre and including 1.07 g/t gold and 0.87 g/t silver over 3.50 metres in drill hole TL25-695; and

- 1.32 g/t gold and 1.10 g/t silver over 7.00 metres, including 8.19 g/t gold and 3.70 g/t silver over 1.00 metres in drill hole TL24-694.

Selected drill intercepts from Far East are provided in Table 2 and include:

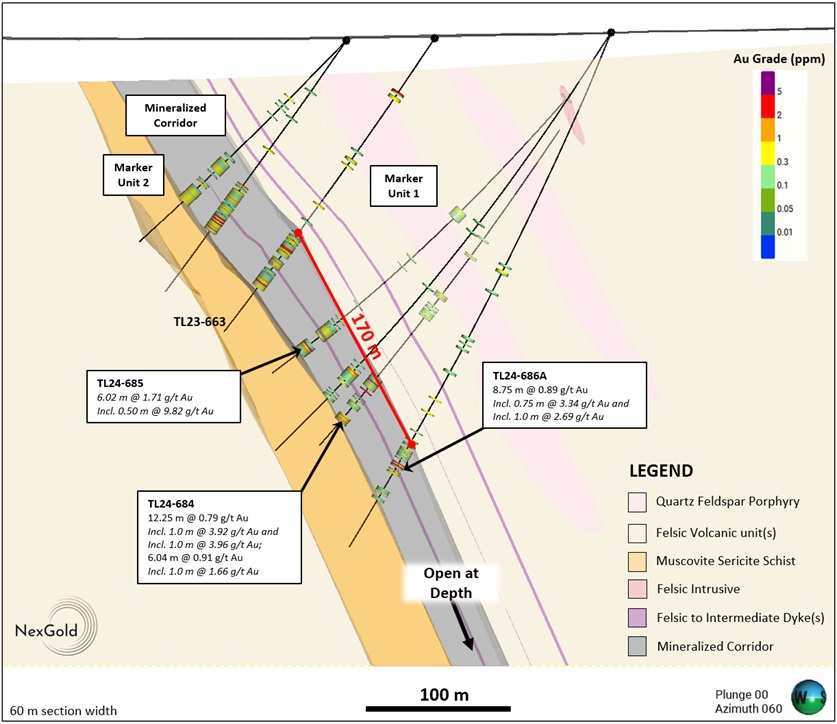

- 1.71 g/t gold and 11.47 g/t silver over 6.02 metres, including 9.82 g/t gold and 56.90 g/t silver over 0.50 metre in drill hole TL24-685;

- 0.79 g/t gold and 2.70 g/t silver over 12.25 metres, including 3.92 g/t gold and 2.70 g/t silver over 1.00 metres and including 3.96 g/t gold and 9.50 g/t silver over 1.00 metres in drill hole TL24-684;

- 0.89 g/t gold and 1.28 g/t silver over 8.75 metres, including 3.34 g/t gold and 0.70 g/t silver over 0.75 metre and including 2.69 g/t gold and 2.10 g/t silver over 1.00 metres in drill hole TL24-686A and;

- 0.91 g/t gold and 8.21 g/t silver over 6.04 metres, including 1.66 g/t gold and 6.60 g/t silver over 1.00 metres in drill hole TL24-684.

Kevin Bullock, President and CEO of NexGold, commented: “The high-grade gold mineralization at Goliath West represents potential extensions of the deposit below the planned open pit. These results could be used in a future mineral resource update to potentially expand the size of the open pit mineral resource at the Goliath Project, while drill results at Far East demonstrate the potential for further discovery at the Goliath Gold Complex. The expansion of mineralization at both Goliath West and Far East is also significant because of the proximity to the proposed processing plant at the Goliath Project, where potential mineral resources could be processed in the future, thus adding longevity to the project life. Building a pipeline of future mill feed beyond the current Feasibility Study work is an important part of our strategy for long term development of the Goliath Gold Complex and creating long term value in the Project.”

Goliath West Results

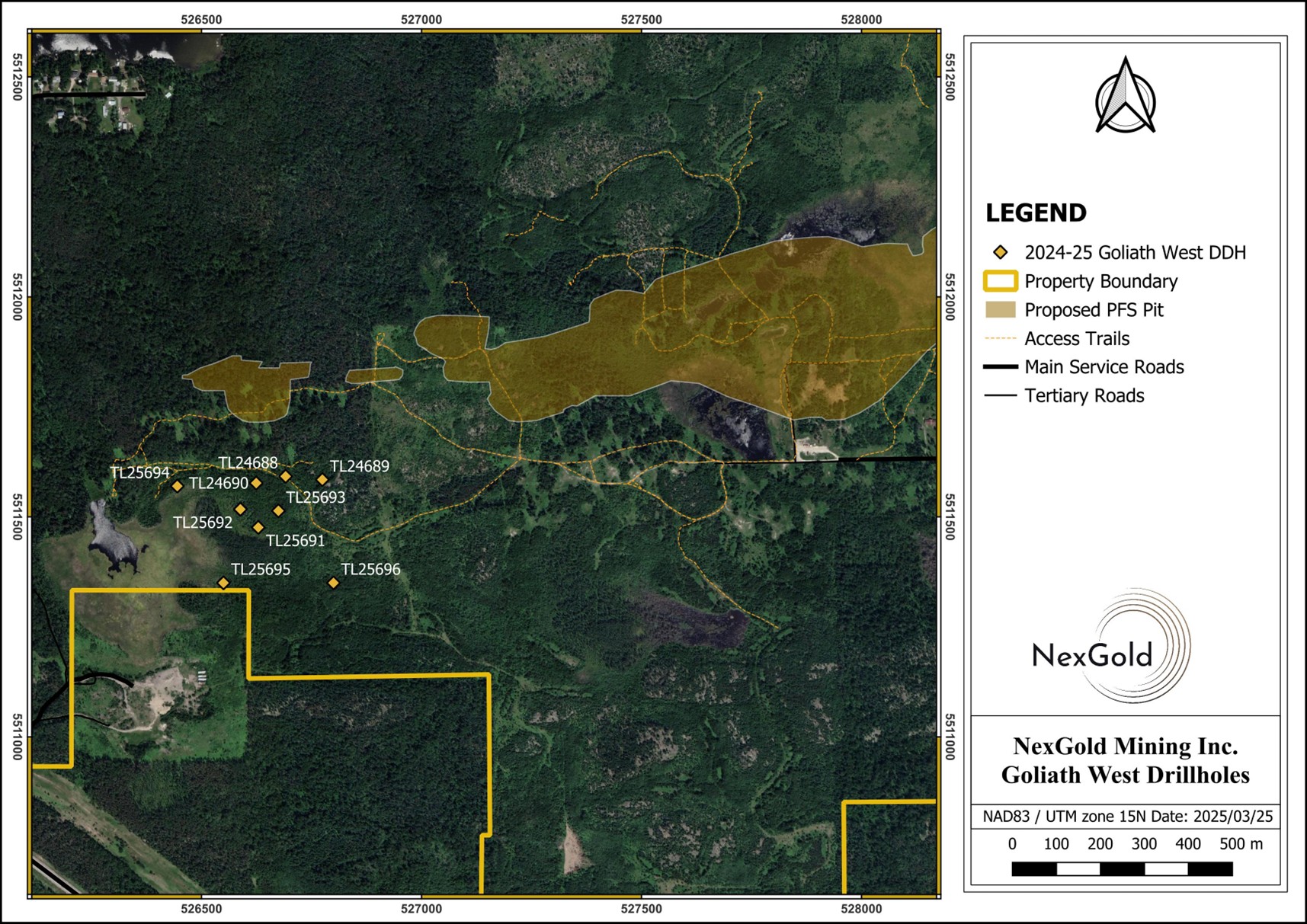

Drilling at Goliath West included 3,759 metres of diamond drilling in nine drill holes (TL24-688 to TL25-696). This drilling was designed to extend the known mineralization of both the Main and C Zones down dip of past drilling and below the open pit proposed in the prefeasibility study for the Goliath Gold Complex (dated February 22, 2023). The drill holes were also designed to investigate the potential continuation of a high-grade shoot down-plunge of previously-announced (February 2, 2022) high-grade gold mineralization, which included 9.55 g/t gold over 5.50 metres including 24.40 g/t gold over 1.50 metres and including 8.60 g/t gold over 1.50 metres (TL21-559) (Figures 1 and 2). All holes were successful in intersecting the intended zones with elevated gold values. In addition, gold mineralization was found in the deepest holes drilled (TL25-695 and TL25-696), extending the maximum depth at the west end of the deposit from 300 metres to approximately 450 metres from surface. Gold mineralization in this area remains open at depth.

Figure 1: Goliath Deposit Drillhole Plan Map

https://www.globenewswire.com/NewsRoom/AttachmentNg/ce80945f-9ba8-4ac7-bc22-a7e5246dc92b

Table 1: Highlighted drill intercepts from drilling at Goliath West |

||||||

| Hole ID | Zone | From (m) | To (m) | Interval (m) | Gold (g/t) | Silver (g/t) |

| TL24-689 | Hanging wall | 160.00 | 164.78 | 4.78 | 10.25 | 2.81 |

| including | 162.18 | 162.71 | 0.53 | 80.30 | 13.60 | |

| and including | 163.50 | 164.00 | 0.50 | 6.28 | 3.10 | |

| TL24-689 | Main | 263.00 | 272.30 | 9.30 | 0.39 | 1.42 |

| including | 271.80 | 272.30 | 0.50 | 1.88 | 5.90 | |

| TL24-690 | C | 272.00 | 276.00 | 4.00 | 1.23 | 0.86 |

| including | 272.00 | 273.00 | 1.00 | 4.07 | 1.10 | |

| TL25-691 | C | 354.00 | 366.00 | 12.00 | 0.77 | 0.78 |

| including | 354.00 | 355.00 | 1.00 | 3.33 | 0.70 | |

| and including | 361.00 | 362.00 | 1.00 | 3.27 | 1.80 | |

| TL25-692 | Main | 281.45 | 292.25 | 10.80 | 3.05 | 2.06 |

| including | 284.45 | 287.69 | 3.24 | 2.40 | 3.49 | |

| and including | 289.50 | 290.25 | 0.75 | 29.30 | 5.70 | |

| TL25-692 | C | 327.00 | 340.25 | 13.25 | 0.30 | 0.92 |

| including | 329.00 | 330.00 | 1.00 | 1.19 | 2.10 | |

| and including | 339.25 | 340.25 | 1.00 | 1.06 | 0.60 | |

| TL25-693 | C | 336.39 | 340.50 | 4.11 | 0.88 | 2.82 |

| including | 336.39 | 337.00 | 0.61 | 1.58 | 14.30 | |

| and including | 339.90 | 340.50 | 0.60 | 2.72 | 1.20 | |

| TL25-694 | Hanging wall | 150.78 | 156.00 | 5.22 | 1.12 | 1.49 |

| including | 150.78 | 151.50 | 0.72 | 3.95 | 1.70 | |

| and including | 152.00 | 153.40 | 1.40 | 1.14 | 3.27 | |

| TL25-694 | C | 254.00 | 261.00 | 7.00 | 1.32 | 1.10 |

| including | 254.00 | 255.00 | 1.00 | 8.19 | 3.70 | |

| TL25-695 | C | 517.85 | 537.69 | 19.84 | 0.69 | 0.98 |

| including | 518.50 | 519.00 | 0.50 | 12.20 | 7.10 | |

| and including | 531.00 | 534.50 | 3.50 | 1.07 | 0.87 | |

| TL25-696 | C | 549.00 | 559.00 | 10.00 | 0.38 | 1.20 |

Note: Reported intervals are drilled core lengths and do not indicate true widths. True widths are estimated at between 70-100% of core length. For duplicate samples, the original sample assays are used to calculate the intersection grade. All grades are uncapped.

Figure 2: Long section showing recent drillhole intercepts at Goliath Deposit (viewed looking north)

https://www.globenewswire.com/NewsRoom/AttachmentNg/aa3c7282-9750-410f-a2ad-413abe84a12b

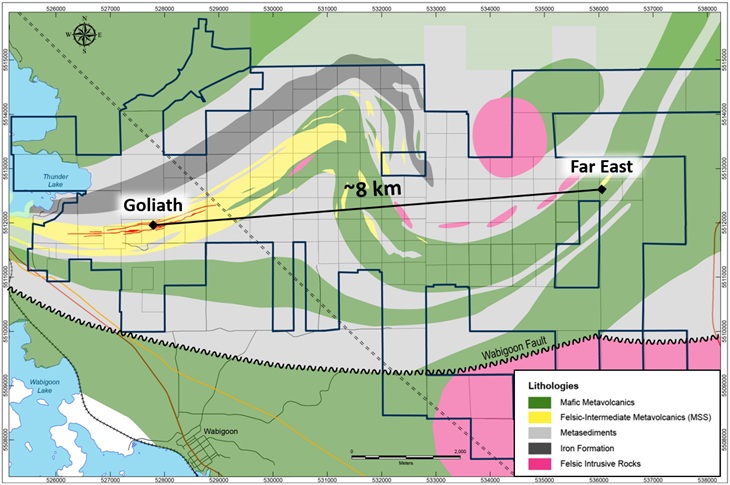

Figure 3: Geological map showing location of the Far East target 8 kms east of the Goliath Deposit

https://www.globenewswire.com/NewsRoom/AttachmentNg/eb1735d9-ed8c-450b-a082-0bb5adf04566

Far East Results

Drilling at Far East included 2,328 metres of diamond drilling in six drill holes (TL24-682 to TL24-687), designed to follow-up on previous drilling that outlined a zone of gold and silver mineralization over a strike length of 600 metres and down to a depth of 200 metres (Figures 3 and 4). The current drill results are significant in that they intersected gold and silver mineralization immediately below the previously-announced (February 29, 2024) gold mineralization that included 0.54 g/t gold over 42.90 metres and 1.13 g/t gold over 7.90 metres (TL23-663) and have successfully extended mineralization down dip by 170 metres from that hole to a new maximum depth of approximately 300 metres from surface. Gold mineralization in this area remains open at depth and along strike to the southwest. Gold and silver mineralization at Far East is hosted within similar host rocks, alteration and sulphide mineralization (pyrite, sphalerite) as that at the Goliath Deposit.

Figure 4: Cross section showing recent drillholes at Far East (viewed looking northeast)

https://www.globenewswire.com/NewsRoom/AttachmentNg/5d6e6b90-1597-455e-94c3-d072945b7bca

Table 2: Highlighted drill intercepts from drilling at the Far East Prospect |

|||||

| Hole ID | From (m) | To (m) | Interval (m) | Gold (g/t) | Silver (g/t) |

| TL24-682 | 242.20 | 253.00 | 10.80 | 0.25 | 6.40 |

| TL24-682 | 331.00 | 332.00 | 1.00 | 2.45 | 3.30 |

| TL24-683 | 313.61 | 321.00 | 7.39 | 0.34 | 6.98 |

| including | 318.00 | 319.00 | 1.00 | 1.18 | 3.20 |

| TL24-684 | 221.50 | 224.50 | 3.00 | 0.90 | 19.33 |

| TL24-684 | 231.50 | 242.25 | 10.75 | 0.23 | 10.04 |

| TL24-684 | 295.75 | 308.00 | 12.25 | 0.79 | 2.70 |

| including | 299.00 | 300.00 | 1.00 | 3.92 | 2.70 |

| and including | 307.00 | 308.00 | 1.00 | 3.96 | 9.50 |

| TL24-684 | 329.50 | 335.54 | 6.04 | 0.91 | 8.21 |

| including | 330.50 | 331.50 | 1.00 | 1.66 | 6.60 |

| TL24-685 | 289.61 | 300.73 | 11.12 | 0.38 | 6.96 |

| including | 300.23 | 300.73 | 0.50 | 1.48 | 15.40 |

| TL24-685 | 309.48 | 315.50 | 6.02 | 1.71 | 11.47 |

| including | 310.50 | 311.00 | 0.50 | 9.82 | 56.90 |

| TL24-686A | 334.25 | 343.00 | 8.75 | 0.89 | 1.28 |

| including | 334.25 | 335.00 | 0.75 | 3.34 | 0.70 |

| and including | 336.00 | 337.00 | 1.00 | 2.69 | 2.10 |

| TL24-687 | 296.85 | 309.00 | 12.15 | 0.38 | 4.61 |

| including | 297.50 | 298.00 | 0.50 | 2.04 | 20.20 |

| and including | 299.00 | 300.00 | 1.00 | 1.23 | 14.70 |

Note: Reported intervals are drilled core lengths and do not indicate true widths. True widths are estimated at between 80-100% of core length. For duplicate samples, the original sample assays are used to calculate the intersection grade. All grades are uncapped.

Ontario Junior Exploration Program

Drilling at Far East was supported by the Ontario Junior Exploration Program which provides financing to exploration projects to help boost mineral exploration, growth and job creation in the province, particularly in northern and Indigenous communities. The Company has received $200,000 to cover eligible costs related to the program.

QA / QC

The Company has implemented a quality assurance and quality control (QA/QC) program to ensure sampling and analysis of all exploration work is conducted in accordance with the CIM Exploration Best Practices Guidelines. The NQ diameter drill core is sawn in half with one-half of the core sample dispatched to a third party analytical laboratory, Activation Laboratories Ltd. Facility, located in Dryden, Ontario for sample preparation and fire assay. The other half of the core is retained for future assay verification and/or metallurgical testing. The sample is then sent to Activation Laboratories Ltd. facility located in Thunder Bay, Ontario for Aqua Regia ICP analysis with silver assays reported from this analysis. Other QA/QC procedures include the insertion of blanks and Canadian Reference Standards for every tenth sample in the sample stream. A quarter core duplicate is assayed every 20th sample. The laboratory has its own QA/QC protocols running standards and blanks with duplicate samples in each batch stream for all analysis. Additional checks are routinely run on anomalous values including gravimetric analysis and pulp metallic screen fire assays. Gold analysis is conducted by lead collection, fire assay with atomic absorption and/or gravimetric finish on a 50-gram sample. Check assays are conducted at a secondary ISO certified laboratory (in this case AGAT Laboratories located in Mississauga, Ontario) following the completion of a program.

Corporate Awareness and Marketing Agreement

NexGold also announces that it has entered into a corporate awareness agreement with Quantum Ventures Inc. (the “Consultant”) dated April 9, 2025. Pursuant to the agreement, the Consultant has been engaged to provide certain services, including advising with regard to media creation, online awareness strategies and introduction to relevant business contacts and appropriate strategic partners. The agreement will remain in effect for a period of two (2) months, commencing on April 15, 2025, and is subject to extension by mutual agreement of the parties. In accordance with the terms and conditions of the agreement and as consideration for the services provided by the Consultant, the Company has agreed to pay the Consultant a fee of C$175,000. The Company and the Consultant act at arm’s length, and the Consultant has no present interest, directly or indirectly, in the Company or its securities, or any right or present intent to acquire such an interest. The Consultant is based in British Columbia.

The Agreement is subject to approval of the TSX Venture Exchange. The Consultant has agreed to comply with all applicable securities laws and the policies of the Exchange in providing the services to the Company.

Qualified Person

Paul McNeill, P.Geo., VP Exploration of NexGold, is considered a “Qualified Person” for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects and has reviewed and approved the scientific and technical disclosure contained in this news release on behalf of NexGold.

About NexGold Mining Corp.

NexGold Mining Corp. is a gold-focused company with assets in Canada and Alaska. NexGold’s Goliath Gold Complex (which includes the Goliath, Goldlund and Miller deposits) is located in Northwestern Ontario and its Goldboro Gold Project is located in Nova Scotia. NexGold also owns several other projects throughout Canada, including the Weebigee-Sandy Lake Gold Project JV, and grassroots gold exploration property Gold Rock. In addition, NexGold holds a 100% interest in the high-grade Niblack copper-gold-zinc-silver VMS project, located adjacent to tidewater in southeast Alaska. NexGold is committed to inclusive, informed and meaningful dialogue with regional communities and Indigenous Nations throughout the life of all our Projects and on all aspects, including creating sustainable economic opportunities, providing safe workplaces, enhancing of social value, and promoting community wellbeing.

Further details about NexGold, including a Prefeasibility Study for the Goliath Gold Complex and a Feasibility Study for the Goldboro Gold Project, are available under the respective issuer profiles of the Company and Signal Gold Inc., on www.sedarplus.ca and on NexGold’s website at www.nexgold.com.

Contact:

| Kevin Bullock President & CEO (647) 388-1842 kbullock@nexgold.com |

Orin Baranowsky Chief Financial Officer (647) 697-2625 obaranowsky@nexgold.com |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Cautionary Note Regarding Forward-Looking Information

This news release contains or incorporates by reference “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of applicable U.S. securities laws. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward-looking information including, but not limited to information as to the Company’s strategic objectives and plans, potential for, and results from, further discoveries, timing of exploration activities and expected initiatives to be undertaken by management of the Company in identifying exploration and development opportunities. Generally, forward-looking information is characterized by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “is projected”, “anticipates” or “does not anticipate”, “believes”, “targets”, or variations of such words and phrases. Forward-looking information may also be identified in statements where certain actions, events or results “may”, “could”, “should”, “would”, “might”, “will be taken”, “occur” or “be achieved”.

Forward-looking information involve known or unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of the Company to be materially different from those projected by such forward-looking statements. Such factors include, among others: the plan for, and actual results of, current exploration activities; risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; reliance on third-parties, including governmental entities, for mining activities; the ability of NexGold to complete further exploration activities, including drilling at the Goliath Gold Complex and Goldboro Project deposits; the ability of the Company to obtain required approvals; the results of exploration activities; risks relating to mining activities; and those factors described in the Company’s Annual Information Form for the year ended December 31, 2023 and in the Company’s most recent disclosure documents filed under the Company’s SEDAR+ profile at www.sedarplus.ca. Although management of the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers are cautioned not to place undue reliance on forward-looking information. The forward-looking information contained herein is presented to assist shareholders in understanding the Company’s the Company’s plans and objectives and may not be appropriate for other purposes. The Company does not undertake to update any forward-looking information contained herein, except in accordance with applicable securities laws.