April 28, 2022

Highlights:

- New vein-hosted, lode-gold style mineralization identified on Goliath property;

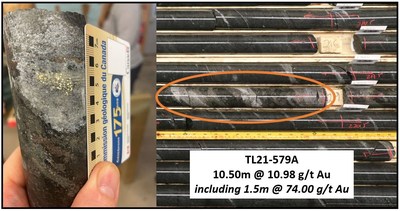

- Fold Nose hole TL21-579A intersected 10.98 g/t Au over 10.5 metres from 210.0 to 220.5 metres downhole including 74.00 g/t Au over 1.5 metres from 217.5 to 219.0 metres downhole;

- Mira Geoscience engaged for geophysics reprocessing, 3D inversion and geological modelling for the Fold Nose area.

TORONTO, April 28, 2022 /CNW/ – Treasury Metals Inc. (TSX: TM) (OTCQX: TSRMF) (“Treasury” or the “Company”) is pleased to announce additional results from the Fold Nose exploration target on the Goliath gold property (“Goliath”), part of the Company’s Goliath Gold Complex (“GGC” or the “Project”). The Fold Nose drill program has intersected a new style of mineralization at Goliath – a vein-hosted, lode-gold style mineralization. Results released today expand upon the two holes targeting the Fold Nose that the Company released on February 17, 2022. Overall, the Company completed a ten-hole (2,868 metre) drill program on the Fold Nose exploration area in 2021.

Jeremy Wyeth, President and CEO of Treasury Metals, commented: “I am very pleased with the discovery of a vein-hosted, lode-gold style of mineralization on the Goliath property at the Fold Nose target. Having multiple styles of mineralization is typically found in larger gold camps in Canada such as Timmins, Red Lake and in the Val D’Or-Rouyn area, where multi-million ounce deposits are located. We are excited about the prospects for growth in our emerging gold camp and have enlisted the services of Mira Geoscience to assist our team in our geological interpretations over our 65-km strike length to better define additional high-grade targets on our 330 square km land package.”

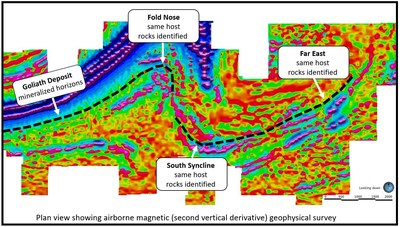

One of the primary focuses for the Treasury Metals geology team over the past year has been target generation. Beginning late in 2021, the Company tested grassroots exploration targets with 25 holes (7,650 metres) at Goliath and will continue to be the main focus of the Company’s 25,000 metre drill program in 2022. The geology team has been working on a Goliath property-scale model to help define the extent of the host rocks for the Goliath Deposit. The team has successfully identified the hosting felsic volcanic rocks at several locations across the property and has begun testing for mineralization during the 2022 exploration program (Figure 1).

At the Goliath property, the geology team has used both geophysical and soil anomalies to identify targets with similar signatures to the main Goliath Gold Deposit. However, the potential for the “more typical high-grade Archean greenstone hosted” style of gold mineralization is another exploration target for the team. Synthesis and re-interpretation of new and historical results from the Fold Nose has resulted in the discovery of a new style of mineralization at Goliath. North and south of the Goliath felsic host rock lays intercalated metasedimentary rocks with mafic flows; this host rock, referred to as greenstone, is a characteristic host for Archean lode gold. The Fold Nose area has undergone limited geological mapping to identify the relationship between the metasedimentary and mafic flows. The Treasury geology team is planning a field mapping program for summer 2022 in this area to strengthen this interpretation and improve the geological understanding of the Fold Nose Area. In addition, the Company has engaged Mira Geoscience to reinterpret the geophysical data for the area and create a 3D geological model to improve drill targeting. The Fold Nose area is a geologically complex region, and the addition of geological mapping and reinterpretation of the of the geophysical data will help to improve the geological interpretation and reduce the number of drill holes needed to determine stratigraphy and associated mineralization.

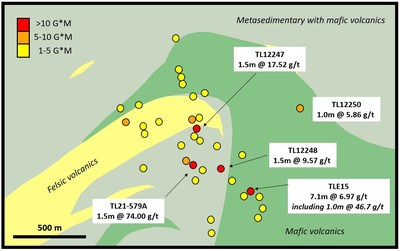

Hole TL21-579A is hosted within the greenstone and the gold mineralization is related to veining with silicified sulphide zones. Gold mineralization in hole TL21-579A graded 10.98 g/t Au over 10.5 metres from 210.0 to 220.5 metres downhole, including 74.00 g/t Au over 1.5 metre from 217.5 to 219.0 metres downhole (Figure 2 and 3). Other high-grade intervals have been encountered in the Fold Nose area in previous drill campaigns. Hole TLE15 intersected 7.1 metres grading 6.97 g/t Au including 1.0 metre grading 46.7 g/t Au. Two holes from the 2012 drill campaign also intersected high-grade gold mineralization, including hole TL12247, which intersected 17.52 g/t Au over 1.5 metres near the contact with the felsic Goliath-style host rock, while hole TL12248 intersected a similar style of silicified mafic flow with grey quartz veining and sulphides, carrying 9.57 g/t Au over 1.5 metres.

Maura Kolb, Director of Exploration at Treasury Metals, stated “The Wabigoon greenstone belt is highly prospective but remains underexplored; the greenstone belt has the right geological ingredients to host a high-grade, greenstone-hosted, lode-gold deposit. We see evidence for late gold mineralization or remobilization at Goliath and the timing for the mineralization at Goldlund indicates the same systems that would cause gold mineralization in the mafic rocks (greenstones).”

Table 1: New Gold Intercepts from Recent Drilling at Fold Nose Target

| Drill Hole | From (m) | To (m) | Sample Length (m) | Grade (g/t Au) | |

| TL21-579 | 18.00 | 21.00 | 3.00 | 0.20 | |

| TL21-579A | 100.50 | 103.50 | 3.00 | 0.33 | |

| TL21-579A | 145.50 | 147.00 | 1.50 | 0.33 | |

| TL21-579A | 210.00 | 220.50 | 10.50 | 10.98 | |

| including | 217.50 | 219.00 | 1.50 | 74.00 | |

| TL21-579A | 276.00 | 292.00 | 16.00 | 0.63 | |

| including | 282.00 | 286.50 | 4.50 | 1.29 | |

| TL21-582 | 83.20 | 117.00 | 33.80 | 0.14 | |

| including | 83.20 | 89.50 | 6.30 | 0.39 | |

| and including | 86.60 | 88.00 | 1.40 | 1.19 | |

| TL21-582 | 160.50 | 162.00 | 1.50 | 1.12 | |

| TL21-584 | 55.50 | 57.00 | 1.50 | 1.69 | |

| TL21-584 | 108.00 | 118.50 | 10.50 | 0.34 | |

| TL21-584 | 169.50 | 175.50 | 6.00 | 0.28 | |

| TL21-584 | 295.50 | 297.00 | 1.50 | 0.65 | |

| TL21-586 | 9.60 | 73.40 | 63.80 | 0.11 | |

| TL21-586 | 141.00 | 142.50 | 1.50 | 1.16 | |

| TL21-586 | 285.00 | 291.00 | 6.00 | 0.36 | |

| TL21-588 | 16.50 | 18.00 | 1.50 | 0.72 | |

| TL21-588 | 51.00 | 55.50 | 4.50 | 0.19 | |

| TL21-588 | 73.50 | 75.00 | 1.50 | 0.49 | |

| TL21-588 | 145.00 | 196.50 | 51.50 | 0.11 | |

| TL21-590 | No significant results | ||||

| TL21-592 | 304.00 | 305.30 | 1.30 | 0.61 | |

| TL21-592 | 321.60 | 322.60 | 1.00 | 0.42 | |

| TL21-592 | 348.00 | 351.00 | 3.00 | 0.77 | |

| including | 350.00 | 351.00 | 1.00 | 1.89 | |

| Note: Reported intervals are drilled core lengths and do not indicate true widths. For duplicate samples, the original sample assays are used to calculate the intersection grade. All grades are un-capped. |

QA / QC

The Company has implemented a quality assurance and quality control (QA/QC) program to ensure sampling and analysis of all exploration work is conducted in accordance with the CIM Exploration Best Practices Guidelines. The drill core is sawn in half with one-half of the core sample dispatched to Activation Laboratories Ltd. facility located in Dryden, Ontario. The other half of the core is retained for future assay verification and/or metallurgical testing. Other QA/QC procedures include the insertion of blanks and Canadian Reference Standards for every tenth sample in the sample stream. A quarter core duplicate is assayed every 20th sample. The laboratory has its own QA/QC protocols running standards and blanks with duplicate samples in each batch stream. Additional checks are routinely run on anomalous values including gravimetric analysis and pulp metallic screen fire assays. Gold analysis is conducted by lead collection, fire assay with atomic absorption and/or gravimetric finish on a 50-gram sample. Check assays are conducted at a secondary ISO certified laboratory (in this case AGAT Laboratories located in Mississauga, Ontario) following the completion of a program.

Qualified Persons

Maura Kolb, M.Sc., P.Geo., Director of Exploration and Adam Larsen, P. Geo., Exploration Manager, are both considered as a “Qualified Person” for the purposes of National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”), and have reviewed and approved the scientific and technical disclosure contained in this news release on behalf of Treasury.

About Treasury Metals Inc.

Treasury Metals Inc. is a gold focused company with assets in Canada. Treasury’s Goliath Gold Complex, which includes the Goliath, Goldlund and Miller deposits, is located in Northwestern Ontario. The deposits benefit substantially from excellent access to the Trans-Canada Highway, related power and rail infrastructure, and close proximity to several communities including Dryden, Ontario. The Company also owns several other projects throughout Canada, including the Lara Polymetallic Project, Weebigee-Sandy Lake Gold Project JV, and grassroots gold exploration property Gold Rock. Treasury Metals is committed to inclusive, informed and meaningful dialogue with regional communities and Indigenous Nations throughout the life of all our Projects and on all aspects, including: creating sustainable economic opportunities, providing safe workplaces, enhancing of social value, and promoting community well-being.

For information on the Goliath Gold Complex, please refer to the preliminary economic assessment, prepared in accordance with NI43‑101, entitled “NI 43‐101 Technical Report & Preliminary Economic Assessment of the Goliath Gold Complex: and dated March 10, 2021 with an effective date of January 28, 2021, led by independent consultants Ausenco Engineering Canada Inc. The technical report is available on SEDAR atwww.sedar.com, on the OTCQX at www.otcmarkets.com and on the Company website at www.treasurymetals.com.

To view further details about Treasury, please visit the Company’s website at www.treasurymetals.com.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This release includes certain statements that may be deemed to be “forward-looking statements”. All statements in this release, other than statements of historical facts, that address events or developments that management of the Company expect, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “plans”, “projects”, “intends”, “estimates”, “envisages”, “potential”, “possible”, “strategy”, “goals”, “objectives”, or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions. Actual results or developments may differ materially from those in forward-looking statements. Treasury disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, save and except as may be required by applicable securities laws.

Since forward-looking information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, exploration and production for precious metals; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of resource estimates; health, safety and environmental risks; worldwide demand for gold and base metals; gold price and other commodity price and exchange rate fluctuations; environmental risks; competition; incorrect assessment of the value of acquisitions; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws, royalties and environmental regulations.

Actual results, performance or achievement could differ materially from those expressed in, or implied by, the forward-looking information and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits may be derived therefrom and accordingly, readers are cautioned not to place undue reliance on the forward-looking information.

Note to United States Investors

All resource estimates included in this press release have been prepared in accordance with Canadian standards, which differ in some respects from United States standards. In particular, and without limiting the generality of the foregoing, the terms “inferred mineral resources,” “indicated mineral resources,” “measured mineral resources” and “mineral resources” that may be used or referenced are Canadian mining terms as defined in accordance with National Instrument 43 101 – Standards of Disclosure for Mineral Projects under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resources and Mineral Reserves (the “CIM Standards”). The CIM Standards differ significantly from standards in the United States. While the terms “mineral resource,” “measured mineral resources,” “indicated mineral resources,” and “inferred mineral resources” are recognized and required by Canadian regulations, they are not defined terms under standards in the United States. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies. Readers are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into reserves. Readers are also cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, United States companies are only permitted to report mineralization that does not constitute “reserves” by standards in the United States as in place tonnage and grade without reference to unit measures. Accordingly, information regarding resources contained or referenced in this [name of disclosure document] containing descriptions of our mineral deposits may not be comparable to similar information made public by United States companies.

SOURCE Treasury Metals Inc.